An Insurance CRM Tailored to Your Team’s Needs

Stop settling for a one size fits all insurance CRM. Experience the power of customizing the Gen4 CRM to your team’s needs.

Built for Brokers - Customized to Your Team

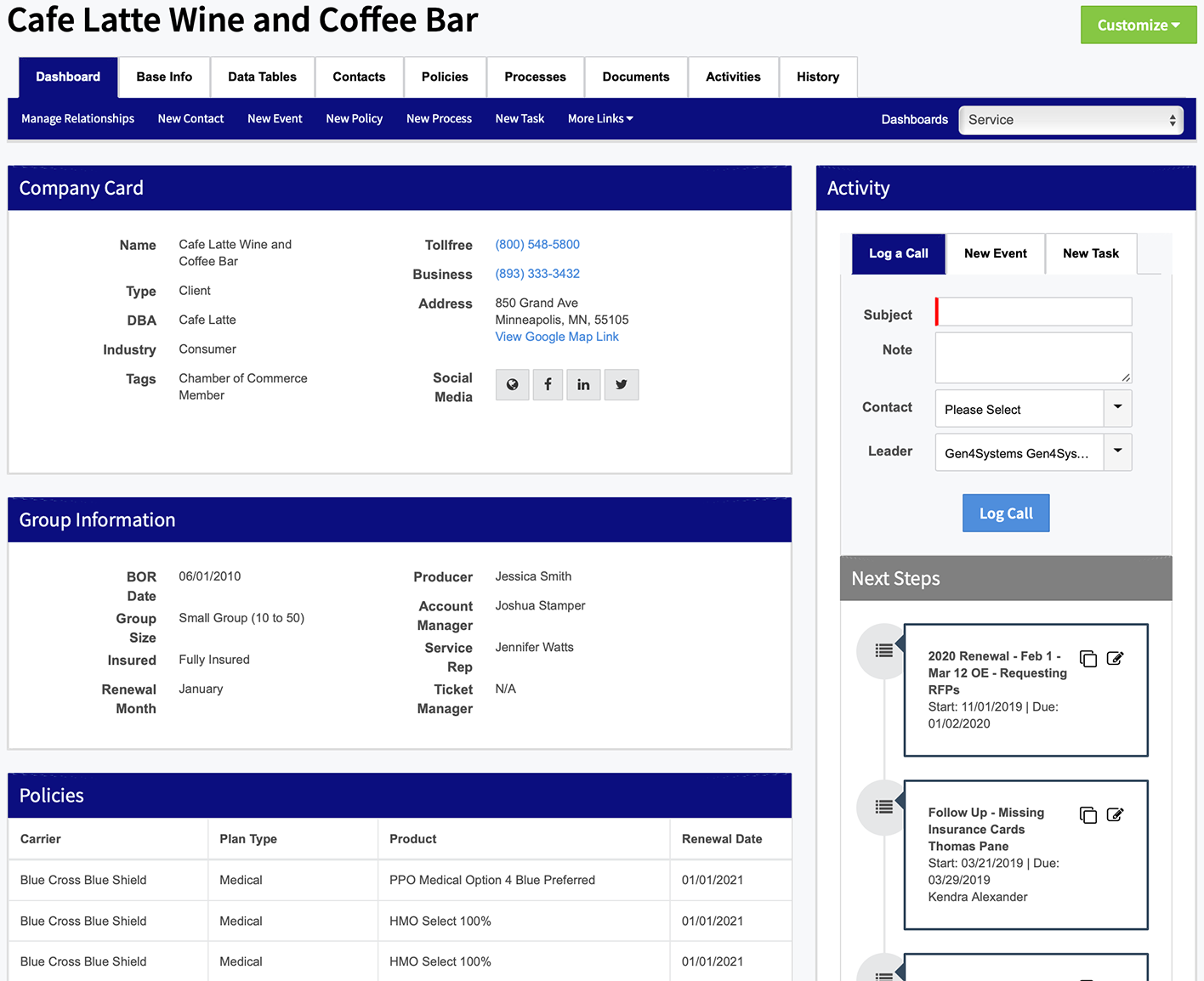

ONE AGENCY CRM FOR ALL YOUR NEEDS

One easy to use system for managing all your business contacts: clients, carriers, competitors, prospects, leads, relationships, and more.

DESIGNED FOR GROUP & INDIVIDUAL BROKERS

The Gen4 platform has been uniquely tailored with all the tools needed for group and individual insurance brokers.

INTEGRATED SALES & SERVICE SYSTEMS

Two applications, one system. Empower your producers with a dedicated sales system that seamlessly integrates with your agency CRM.

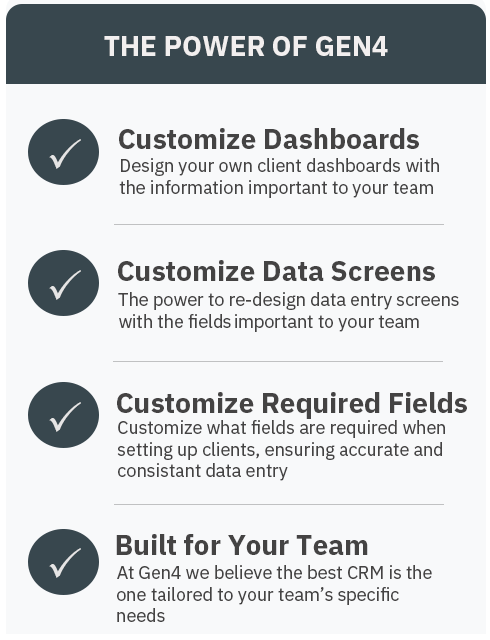

CUSTOMIZED TO YOUR TEAM

The Gen4 platform is designed to be customized to your team. Move fields around, change screens, build custom dashboards, let’s do it!

Everything Your Team Needs in One Package

DOCUMENT MANAGEMENT

Document storage solutions for all your team’s needs: from policy summaries to rate sheets to BORs and more.

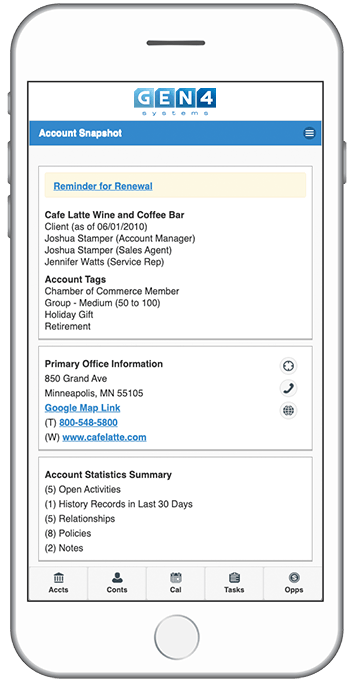

PHONE, TABLET, LAPTOP, LARGE DESKTOP SOLUTIONS

Your Gen4 system goes wherever you go. Access from your smart phone, fully functional for dedicated tablet users, or via your desktop.

TO-DO, NOTE TRACKING, CUSTOMER SERVICE ISSUES

Track your notes, client issues, follow-ups, next steps and more. Gen4’s task management system in unparalleled in the industry.

MICROSOFT OUTLOOK INTEGRATION FOR MAC & PC

The industry’ deepest integration with Microsoft Outlook. Is your team Mac users? We have you covered here as well.